As a firm that caters to individual wealth management, we create and manage investment portfolios for clients from a wide variety of nationalities, offering a highly personalised service.

Portfolios may include bonds, equities, and a variety of investment funds including hedge funds, in a range of currencies, with a selective use of options strategies. We provide portfolios in Euros, Dollars, Sterling and Swiss Francs.

As a firm that caters to individual wealth management, we create and manage investment portfolios for clients from a wide variety of nationalities, offering a highly personalised service.

Portfolios may include bonds, equities, and a variety of investment funds including hedge funds, in a range of currencies, with a selective use of options strategies. We provide portfolios in Euros, Dollars, Sterling and Swiss Francs.

Independent & Unbiased

Our clients stay with us because we provide advice which benefits them – not us.

Income & Growth

Our investment plans help you deliver proven results and returns, bringing you closer to your financial goals in better time.

Greater Clarity

The investment world can be confusing, even for very successful people. Our experts bring clarity so you understand the choices before you.

Stability & Peace of Mind

Investment volatility is normal, but we help you manage and mitigate it through careful portfolio construction and management.

Healthy Risk Management

Perhaps your goal is to preserve wealth, or maybe to create it. Regardless, we always work with your risk tolerance in mind.

A Trusted Adviser

Our clients stay with us for many years (multi-generational), because we deliver results and build a strong relationship with them.

Our client relationship begins with a number of initial personal meetings to allow us to fully understand their needs and requirements and to discuss in depth the appropriate strategy for their account. Thereafter we hold regular meetings with each client to review and discuss issues as they arise and to review their portfolio in the light of their longer financial planning.

Our client relationship begins with a number of initial personal meetings to allow us to fully understand their needs and requirements and to discuss in depth the appropriate strategy for their account. Thereafter we hold regular meetings with each client to review and discuss issues as they arise and to review their portfolio in the light of their longer financial planning.

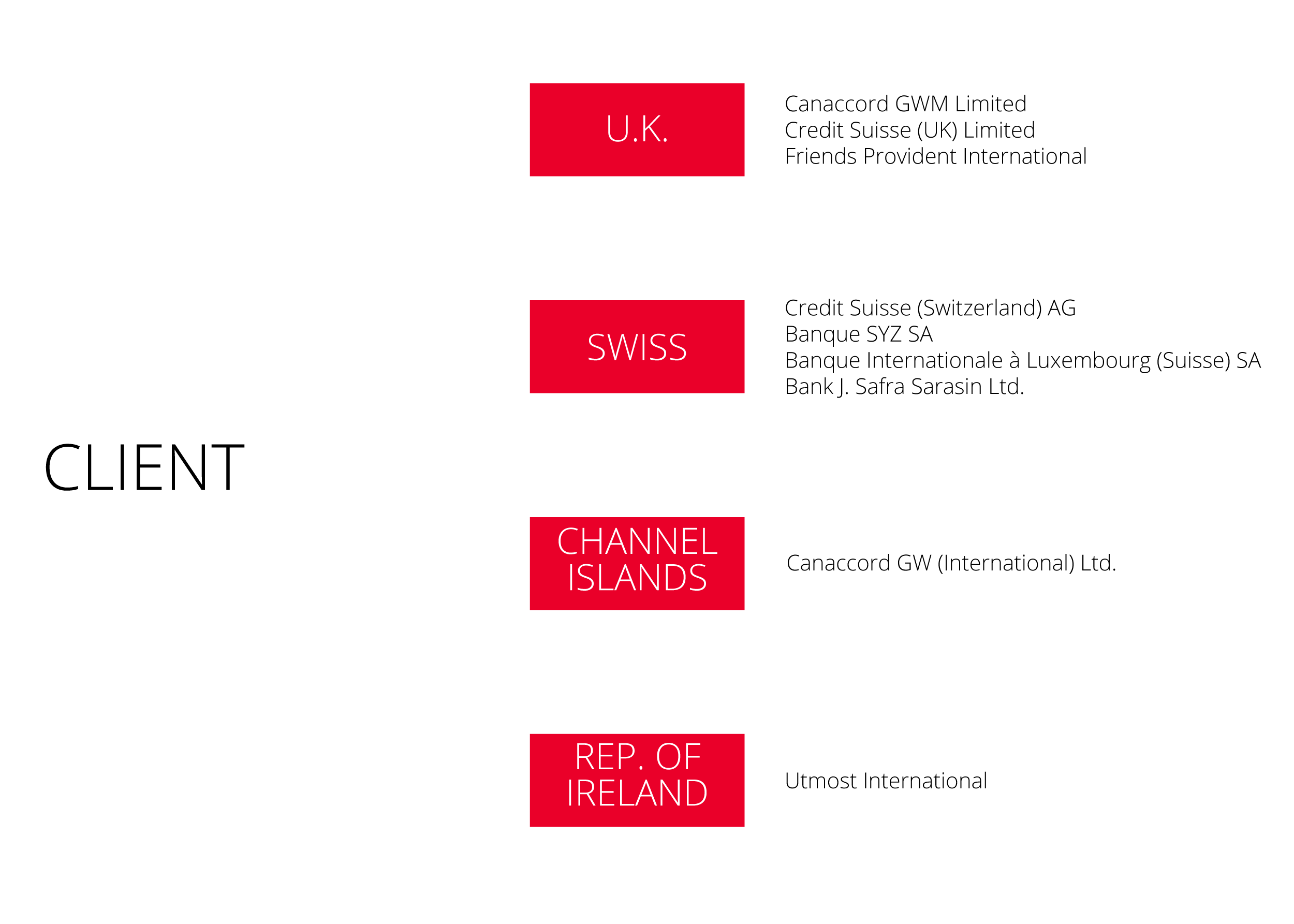

Our average client has between one and five million dollars under our management. Our clients’ portfolios are held in accounts in their own name at well-known international custodians of the highest financial security, reputation and quality.

ISGAM has the authority to invest and manage assets within the account according to a rigid and contractual portfolio management agreement.